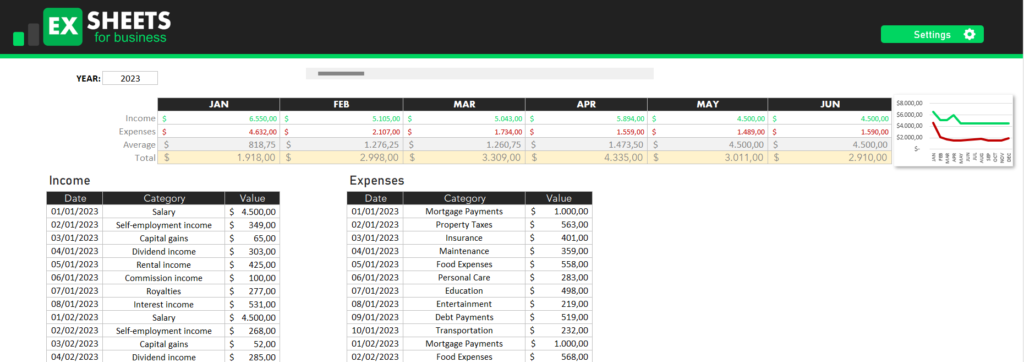

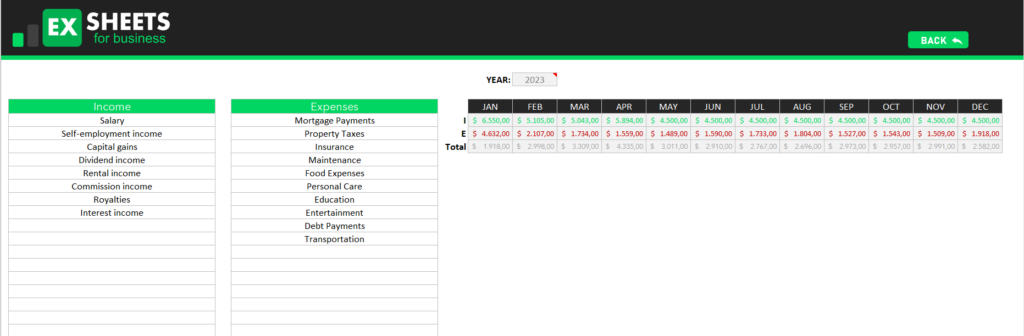

Monthly Cash Flow Worksheet: A Powerful Tool for Financial Planning

Effective financial planning is essential to achieve your financial goals and secure your financial future. One of the most important aspects of financial planning is to track your monthly income and expenses. A monthly cash flow worksheet is a powerful tool that can help you manage your money effectively and stay on track with your financial goals.

A monthly cash flow worksheet is a simple spreadsheet that lists your monthly income and expenses. By tracking your income and expenses, you can identify areas where you can save money, reduce expenses, and make better financial decisions. You can also use a monthly cash flow worksheet to create a budget, manage debt, and plan for future expenses.

To get started, you can download a free monthly cash flow worksheet from our website. Our worksheet is easy to use and customizable, so you can adjust it to your specific needs. Here are some steps to follow to use the worksheet effectively. DOWNLOAD BELOW:

Step 1: List Your Monthly Income

The first step is to list all your sources of monthly income. This includes your salary, bonuses, rental income, and any other sources of income you have. Be sure to list the net income (after taxes and deductions) for each source.

Step 2: List Your Monthly Expenses

Next, list all your monthly expenses. This includes your rent or mortgage payments, utilities, groceries, transportation, entertainment, and any other expenses you have. Be sure to categorize your expenses so that you can see where your money is going.

Step 3: Calculate Your Net Income

After listing your income and expenses, calculate your net income. This is the difference between your total income and total expenses. If your net income is positive, you are living within your means and have some money left over for savings or investments. If your net income is negative, you need to find ways to reduce your expenses or increase your income.

Step 4: Adjust Your Budget

Based on your net income, you may need to adjust your budget. If your net income is positive, you can allocate more money to savings or investments. If your net income is negative, you need to find ways to reduce your expenses or increase your income. You can do this by cutting back on unnecessary expenses, finding ways to save on essentials, or looking for ways to earn extra income.

Step 5: Track Your Progress

Once you have created your budget, be sure to track your progress each month. This will help you stay on track and make adjustments as needed. You can also use the cash flow spreadsheet to plan for future expenses, such as a vacation or major purchase.

Conclusion

In conclusion, a monthly cash flow worksheet is a powerful tool that can help you manage your money effectively and achieve your financial goals. By tracking your income and expenses, you can identify areas where you can save money, reduce expenses, and make better financial decisions. Download our free Cash flow spreadsheet to plan from our website and start taking control of your finances today!